Us hourly wage tax calculator 2019

For example for 5 hours a month at time and a half enter 5 15. Enter the hourly rate in the Hourly Wage box and the number of hours worked each week into the Weekly Hours box.

Sole Proprietor Vs S Corporation In 2019 S Corporation Sole Proprietor Payroll Taxes

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

. So make sure to file your. All Services Backed by Tax Guarantee. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10 15.

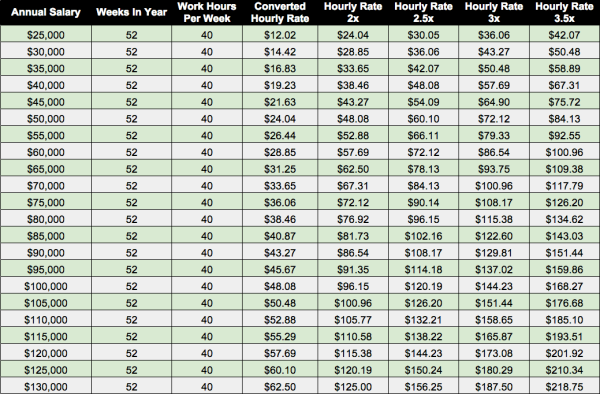

This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. 2019 Hourly Wage Conversion Calculator This free tool makes it quick and easy to convert wages from one time period to another. Enter your income and location to estimate your tax burden.

Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings. This calculator is intended for use by US. The Tax Calculator is free to use and was built as an extension of our simplified salary and tax estimator.

Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. The second algorithm of this hourly wage calculator uses the following equations. Sanderson Farms Increases Pay Rates for Hourly Employees press release June 3 2019.

Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your personal tax questions. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. In the Weekly hours field enter the number of hours you do each week excluding any overtime.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Within United States employees must be paid no less than the minimum wage as specified by the Federal and the local governments. Include your 2019 Income Forms with your 2019 Return.

Click for the 2019 State Income Tax Forms. Get Your Quote Today with SurePayroll. After taking 12 tax from that 16775 we are left with 2013 of tax.

This means that you get a full Federal tax calculation and clear understanding of how the figures are calculated. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. US Salary Tax Calculator Calculate Check how your salary compares to the cost of living in New York Take-Home Pay in the US Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income.

Enter the number of hours and the rate at which you will get paid. First enter an amount you wish to convert then select what time period the earnings are associated with. Given that the second tax bracket is 12 once we have taken the previously taxes 10275 away from 27050 we are left with a total taxable amount of 16775.

Next divide this number from the annual salary. Ad Payroll So Easy You Can Set It Up Run It Yourself. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

After July 15 2023 you will no longer be able to claim your 2019 Tax Refund through your Tax Return. Select your age range from the options displayed. Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income.

2022 Pay Tables by Locality 53 Pay Tables by City State Rest of the US RUS Salary Chart. This comes to 102750. US Tax Calculator 201920.

For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. 5 hours double time would be 5 2. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The tax calculator provides a full step by step breakdown and analysis of each tax Medicare and social security calculation. The US Tax Calculator is an application that allows you to calculate save and print your tax return following simple auto calculating tax forms which mirror the setup and flow of Federal and State tax systems.

What is minimum wage. Youll then get a breakdown of your total tax liability and take-home pay. Find out the benefit of that overtime.

Thats where our paycheck calculator comes in. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C Weekly salary HW LHD. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one.

How do I calculate hourly rate. How to calculate taxes taken out of a paycheck. Get Started Today with 1 Month Free.

The MN Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MNS. Our online Hourly tax calculator will automatically work out all your deductions based on your Hourly pay. It can also be used to help fill steps 3 and 4 of a W-4 form.

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

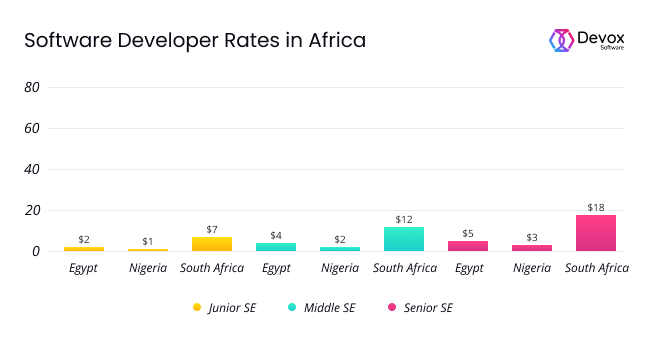

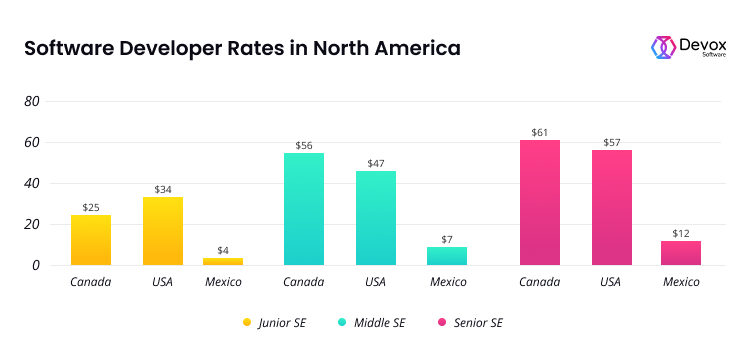

How Much Do Software Developers Make Per Hour Devox Software

Hourly Wage To Salary Hotsell 55 Off Www Ingeniovirtual Com

Why Pr Agencies Should Scrap The Hourly Rate Model Pr Daily Medical Billing Invoicing Software Audit Services

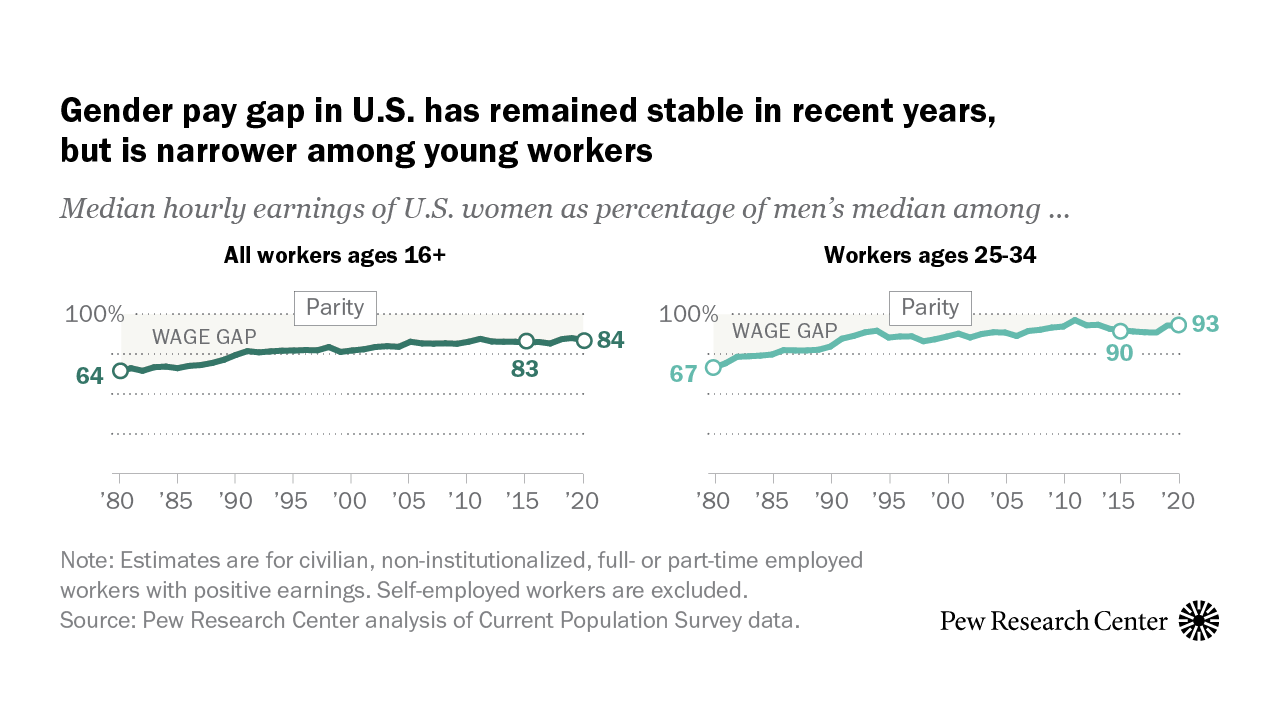

Gender Pay Gap In U S Held Steady In 2020 Pew Research Center

Calculate Child Support Payments Child Support Calculator Parental Income Influences Child Support Child Support Quotes Child Support Child Support Payments

Hourly Paycheck Calculator Primepay

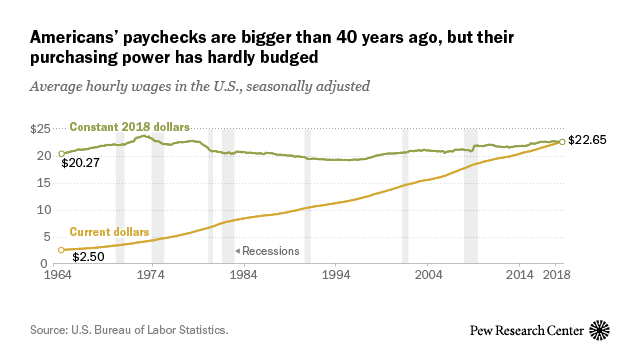

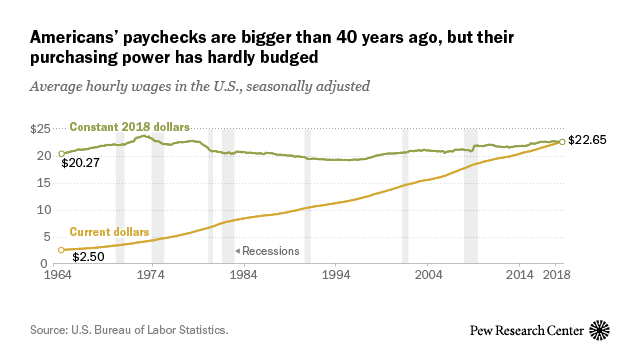

For Most Americans Real Wages Have Barely Budged For Decades Pew Research Center

How Much Do Software Developers Make Per Hour Devox Software

Salary Breakup Calculator Excel 2019 Salary Structure Calculator Breakup Salary Excel

Celebrating Petanque

Free Printable Weekly Hourly Daily Planner Student Handouts Weekly Planner Template Daily Planner Template Weekly Planner Free Printable

Free Debt Snowball Worksheet Crush Your Debt Faster

Hourly Paycheck Calculator Nevada State Bank

The Problem With Average Hourly Earnings

Hourly Wage To Salary Clearance 60 Off Www Ingeniovirtual Com

Hourly To Salary Calculator Convert Your Wages Indeed Com